Money, Memories, and Mission: How My Financial Journey Began with a Pony

Oct 19, 2024

From as far back as I can remember, I’ve always had a fascination with money. I saw it not just as currency, but as a powerful tool for achieving dreams and creating possibilities in life.

My first experience with what money could truly do came during my teenage years. I had fallen in love with horses—captivated by the stories of "The Black Stallion" and determined to have a pony of my own. I’m sure my parents thought it was just another fleeting teenage obsession, an impossible dream. But I was determined.

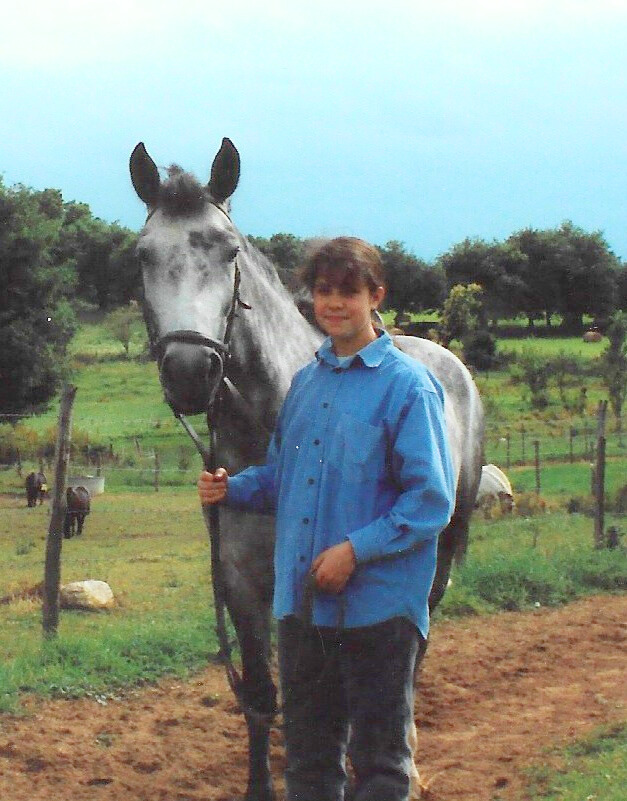

I saved every bit of my allowance, and eventually, my dream became a reality—I bought my very own horse (the picture here is of the day I officially became her owner).

Galloping along the beach with my Camargue pony remains one of my most cherished memories.

In my twenties, I moved from France to the U.S. and began working as a finance associate. This is where my journey into the world of investing began. I had a front-row seat to what was possible, but I also saw the glaring flaws in the industry. I was disheartened by how women were often sidelined in financial discussions, routinely ignored in review meetings. I was implicitly taught that this space wasn’t meant for me, that I couldn’t fully belong here. And if women inside the industry were being treated this way, I could only imagine how women were being overlooked as consumers of financial services.

It was challenging, but much like the determined teenager with a dream of owning a horse, I refused to let the obstacles dim my resolve.

Over the course of my career in finance, I honed my expertise in managing billions of dollars for pension funds, high networth individuals and family offices. Fifteen years gave me the chance to chip away at the societal conditioning that says money—and the management of it—isn't for women.

I’ve been where you are. Creating wealth and achieving peace with your money requires addressing both the inner and outer factors that shape our financial well-being. There’s an intentional illusion of inaccessibility that fuels our lack of confidence and fear. But beyond that, I’ve witnessed how our relationship with ourselves, our bodies, our family history, and societal conditioning profoundly influence how we engage with our finances.

Women are poised to control 67% of U.S. consumer dollars by 2030, and I’m committed to making an impact. I want to be the advocate I wish I’d had years ago—a guide, lighting the way for others.

I look forward to meeting you and growing this community that is all about women, wisdom and wealth.

~ Julie